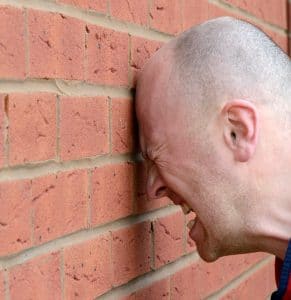

Accountants cannot write CVs. Simple. Here follows a picture of how our consultants feel when they read 90% of CVs we get in from Accountants and Assistant Accountants:

For every 20 CVs we receive in relation to a job:

- 10 will not have the address or postcode of the candidate.

- 1 will be missing the candidate’s name.

- 18 will be missing any information about the level of qualification, particularly if ACCA.

- 15 will have no information about nationality or the right to work.

- 5 will be missing any detail about work experience of any kind related to the job they have applied for.

- 5 will have no experience at all.

- 5 will have experience but we will have to contact the candidate at least twice to get the detail we need out of them.

- 5 will be missing any information about accounting packages used.

- 1 will have all the information we need and possibly be a good fit for the job.

- At least 5 of the CVs will be a good fit but we will never know as we have overlooked them due to some of the above information missing from the CV.

So how should accountants write a CV?

We could write a book on this. Not sure anyone would read it but hopefully a few people will take note of the advice below!

Basic Tasks

Firstly, make sure you do not use any other font other than Times New Roman, Arial or Calibri. Anything else is not necessary.

Secondly, do not use any format other than something extremely simple. Whilst a .pdf CV can look lovely, it causes tremendous headaches when editing and copying into the house layout for recruiters.

Thirdly do not include your photograph. You may look great but we don’t really care.

Word documents are strongly recommended.

Top 25 Tips for Writing an Effective CV for Accountants

- Make sure you include your name, together with your sex – it is not always easy to identify whether we are addressing a Mr Smith or a Mrs Smith for example. Also make sure you identify what you would like to be called – especially if you have three or four names. It is not always obvious.

- Include your postal address. For some reason accountants do not like telling recruiters where they live. The days have gone when candidates would leave their homes to discover a recruitment consultant lurking by the garden gate. Most recruiters use email these days! We need your postal address to identify that a job is going to feasible to commute to – so many candidates apply for roles not realising that the commute from Watford to Maidstone is going to be virtually impossible. A postcode on its own will be absolutely fine.

- Whilst your date of birth is entirely optional, we do like to see it, especially if it is an asset – anything dating you from 25 to 45 years old is an asset, other dates of birth can be a hindrance and left off..

- Your nationality is essential – it is very common in the accounting world for accountants from Asia in particular to apply for jobs and potential have visa issues. We need to know about these issues from the outset and some employers will not consider candidates who have only recently moved to the UK as they have been stung before by a similar issue. If you are an Indian national but have no visa issues and a right to work in the UK, you should definitely explain this to me in your CV from the outset. If I read your CV and find you are an Indian national but I cannot see whether yhou have the right to work, I may not bother actually contacting you if I have other candidates of a better fit.

- Don’t forget your email address. Or your mobile number. We or any employer are unlikely to bother contacting you if you make it hard for us to do so.

- The next section after your personal details section (which should include all of the above) is your personal summary.

- A personal summary is not the opportunity to wax lyrical about the person you wish you were. This is just waffly nonsense: “a versatile, analytical and result orientated person, seeking a challenging and rewarding role in an organisation that offers a position which complements and enhance my skills and competencies.” Does anyone want to read this? No. Unless they are a sado-masochist with lots of time on their hands.

- What your personal summary should be is “ACCA Fully qualified Accountant with 3 years post-qualification experience in practice looking for a new role to progress career. Client manager post of particular interest. IRIS, Xero and Sage experience to date. £40-45k salary range and 3 month notice period.” This information is the usual set of facts we have to contact most candidates to get after they have sent us a CV. It doesn’t take much to include it on the CV in the first place!

- After personal summary is your education. Some accountants take this section to mean that employers want to know all about their time at primary school in 1975. We get lots of CVs with loads of information about every single subject the candidate completed at GCSE level but very little about their ACCA qualification.

- In reality the main focus of your education section needs to be your ACCA, AAT or ACA qualification. If you are QBE (qualified by experience) keep your education section below your work experience section. It is less important.

- Your ACCA information needs to state very clearly exactly what you have done and still have to do. This is by far the biggest fault on every single accountant CV – what are you exactly? So many people put down that they are ACCA Affiliates or ACCA part qualified or ACCA qualified when nothing could be further from the truth. State clearly exactly what exams you have completed, what exam papers you still have to complete and exactly what your status is. Are you a fully qualified accountant with post-qualification experience? Are you an ACCA part qualified accountant with 2 years of practice experience to date? Whatever you are make it easy to work out quickly without the reader needing to decipher your CV.

- The only other interesting information in your eduction that we usually like to see is your degree title, class, location of university (and country please) and the years you did your degree. Confirmation of your A level grades can be good, particularly if one of them is Maths and at a reasonable level. GCSE just needs to say that you have 10 at grades A-C. We don’t need to know anything more than this. Please do not list them – there is nothing worse than half a page of GCSE grades and subjects.

- In fact I tell a lie (something rarely seen on CVs of course!). If you have any advanced qualifications tell us about them – CTA, CII subjects grades etc.. Keep it simple and easy to read though.

- The next section is your work experience. This is definitely the most important part of the CV. There are no other parts of the CV more important than this one. And yet so many accountants mess it up. And we mean really mess it up.

- Put all work experience in reverse alphabetical order. We are concentrating on CVs for accountants in public practice in this article and we are looking particularly for lots of information about practice experience. This does not include experience in industry roles, which is usually ignored by employers unless it has a particular link such as taxation work in a bank for example.

- Each piece of work experience needs to have the date you started and finished – eg 2001 to date, or June 2016 to January 2017.

- Each piece of work experience needs to have the name of the employer or firm you contracted with in full. If they are chartered accountants, accountants, management accountants, tax advisers please tell us. We have to research employers on accountancy CVs every 3-4 CVs we come across – so many accountants naively assume that we or any employer will know that Smith & Co in Ilford are chartered accountants. We don’t and are unlikely to do so if Smith & Co don’t have a website (and so many accountant firms do not). Furthermore sometimes we just can’t be bothered to go and check – why should we if we have 50 CVs to go through? It’s much easier just to move onto the next CV.

- Put your job title on the CV. Again another failure by accountants. We need to know that you are a Senior Accountant, a Client Manager, an Assistant Accountant or whatever you may be. Despite being skilled in mind reading, our telepathic talents sometimes let us down…

- Include a full description of your experience to date. The easiest way of doing this is to have a paragraph explaining who the firm is – how many employees, how many accountants, who the main clients are – eg which sectors they are in – catering, legal, pharmaceutical, etc.. etc.. Are they SME, blue chip, sole traders etc..?

- Bulletpointed lists of your work is by far the easiest and clearest way to present your work. Give facts – one of the biggest failings on CVs is the waffly rubbish people include in this section. We don’t want to know that you are tenacious or enthusiastic about achieving your goals. We don’t care. What we do care about is knowing that you had 150 clients and that you prepared statutory accounts on a regular basis. Give us facts and make sure you include all of them, no matter how mundane.

- However if your piece of work experience was for 2 months, we don’t want a shedload of facts about the experience. Keep it brief. Especially if you got the experience at one of the accountancy firms who seem to specialise in employing graduates for 3-6 months on internships. KBM are one good example.

- Anything non-accountancy related needs to be as brief as possible. We don’t need to know about your team leadership skills when you worked at McDonalds 15 years ago. Really. We (and most employers) don’t care.

- For accounting roles in industry try to include anything that is relevant to practice – eg tax work, or statutory accounts preparation or payroll.

- Keep internship or work experience roles as short as possible.

- The next section after work experience needs to be computer and language skills.

- IT skills for accountants are of vital importance. We get so many firms interested in accountants with specific skills in certain accounts packages. One of the flavours of the month is Xero. Why is this? Because clients actually understand Xero and it is not the nightmare that Sage is to non-accountants. Iris, Sage, Quickbooks are all in demand as well at various times. A lot of accountants fail to remember to include any of this information on their CVs. We want to know about it. We want to know about it because accountancy firms want to know about it. They don’t want to recruit people who don’t know anything about the software they use and there is nothing more annoying than having to email a candidate to ask if they have Xero experience and find out that they are Xero certified with 5 years experience but have failed to include this on the CV.

- Language skills are also very useful. If a firm are located for example in a part of London where there is a large Iranian ex-pat community and you speak Farsi – this information will stand you in good stead for a job application. If you fail to mention it you miss the opportunity to impress. You just never know.

- Finally you should include Activities and Interests. Think of things to do outside of work – eg do you play cricket (very common for male accountants!), attend a yoga class, help out with the local scout troop or a member of the Round Table? Make sure you think of at least 3 interesting things to include. It can make such a difference at interview. It can give you a link to the interviewer and create rapport. Rapport is vital to proceed to job offers at smaller accountancy practices. If someone doesn’t like you it is unlikely they are going to want to work with you. Worst mistake for this section is to say boring bland things like ‘watching TV, reading books, going to the cinema, walking’. You may as well write ‘breathing, sleeping and defecating’.

- References are the final section. Two are the recommendation including a former employer – ideally an employer from the last 5 years. Include a name, company name, brief address, email address and phone number ideally. It is worth checking with your reference that it is OK for potential employers to contact them. We occasionally have incidences of referees being so annoyed at being contacted out of the blue that they write very unhelpful references!

So there we have it. 25 hints at how not to write a CV for accountants. Don’t fall into the trap of producing a substandard CV like most of your counterparts.

Follow the guidance above and your CV will stand out from the crowd – I guarantee it.

I can end this article as it began by saying that accountants are capable of writing successful CVs .. if they follow our expert advice above.

If you would like your CV reviewed by one of our consultants, please click here.

Jonathan Fagan is Managing Director of TP Recruitment Limited and Ten-Percent.co.uk Limited. He has lectured on CV writing for professionals at a University in Yorkshire and also worked with the DWP some years ago on an unemployed executive coaching programme. www.tenpercentfinancial.co.uk is our accountancy practice recruitment website. After sifting through 100s of accountants’ CVs he has finally been driven to writing this article in the forlorn hope it assists accountants to actually write decent CVs rather than the usual rubbish he has to wade through. If you have any questions about the content please email us – we are also happy to comment on this for any press articles. Accountants CVs really are bad and we mean seriously bad – we work in other professional sectors as well but accountancy CVs are by far the worst we have ever seen as a general rule.